What Property Tax Is Based On The Value Of Land And Buildings . the tax is usually based on the value of the owned property, including land and structures. These additions to unaltered land. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. property tax is a levy on certain types of physical property, such as homes, real estate and land. property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. Are based on the market value of a property, including land and alterations to that land (including buildings). property taxes in the u.s. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. How much you pay in property taxes each.

from www.slideshare.net

property tax is a levy on certain types of physical property, such as homes, real estate and land. property taxes in the u.s. How much you pay in property taxes each. the tax is usually based on the value of the owned property, including land and structures. Are based on the market value of a property, including land and alterations to that land (including buildings). click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. These additions to unaltered land.

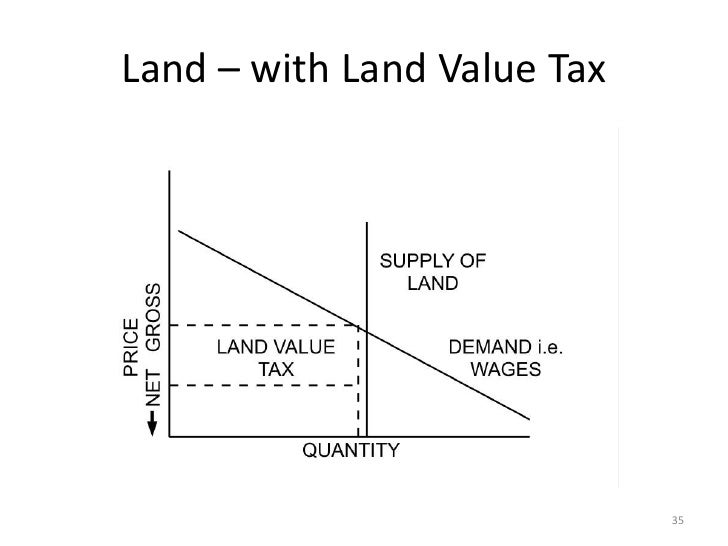

History & Principles of Land Value Tax

What Property Tax Is Based On The Value Of Land And Buildings property tax is a levy on certain types of physical property, such as homes, real estate and land. How much you pay in property taxes each. the tax is usually based on the value of the owned property, including land and structures. These additions to unaltered land. property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. property tax is a levy on certain types of physical property, such as homes, real estate and land. property taxes in the u.s. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. Are based on the market value of a property, including land and alterations to that land (including buildings).

From www.slideserve.com

PPT Volusia County PowerPoint Presentation, free download ID5010276 What Property Tax Is Based On The Value Of Land And Buildings Are based on the market value of a property, including land and alterations to that land (including buildings). property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. click on a state to find the most current information about property tax rates, exemptions, collection. What Property Tax Is Based On The Value Of Land And Buildings.

From www.reddit.com

Property tax versus land value tax (LVT) illustrated What Property Tax Is Based On The Value Of Land And Buildings property taxes in the u.s. Are based on the market value of a property, including land and alterations to that land (including buildings). a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. How much you pay in property taxes each.. What Property Tax Is Based On The Value Of Land And Buildings.

From www.slideserve.com

PPT Buying a Home PowerPoint Presentation, free download ID2931537 What Property Tax Is Based On The Value Of Land And Buildings property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. the tax is usually based on. What Property Tax Is Based On The Value Of Land And Buildings.

From www.slideserve.com

PPT Municipal Finances, Resource Mobilisation and Municipal Budget What Property Tax Is Based On The Value Of Land And Buildings property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. These additions to unaltered land. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. the tax is usually based on the value of. What Property Tax Is Based On The Value Of Land And Buildings.

From www.linkedin.com

Property Taxes How is this calculated, and why is it important? What Property Tax Is Based On The Value Of Land And Buildings How much you pay in property taxes each. property tax is a levy on certain types of physical property, such as homes, real estate and land. click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. These additions to unaltered land. the tax is usually based on the. What Property Tax Is Based On The Value Of Land And Buildings.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans What Property Tax Is Based On The Value Of Land And Buildings property tax is a levy on certain types of physical property, such as homes, real estate and land. These additions to unaltered land. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. property taxes are a type of ad. What Property Tax Is Based On The Value Of Land And Buildings.

From dlrsftsjeco.blob.core.windows.net

Is Property Tax Based On Market Value at Chad Moore blog What Property Tax Is Based On The Value Of Land And Buildings click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. property tax is a levy on certain types of physical property,. What Property Tax Is Based On The Value Of Land And Buildings.

From www.youtube.com

Your homes assessed value for property taxes YouTube What Property Tax Is Based On The Value Of Land And Buildings Are based on the market value of a property, including land and alterations to that land (including buildings). click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. property taxes in the u.s. property tax is a levy on certain types of physical property, such as homes, real. What Property Tax Is Based On The Value Of Land And Buildings.

From www.savingcommunities.org

Land Value Tax Saving Communities What Property Tax Is Based On The Value Of Land And Buildings click on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. property taxes in the u.s. Are based on the market value. What Property Tax Is Based On The Value Of Land And Buildings.

From bitbarn.co.uk

Land Value Tax What Property Tax Is Based On The Value Of Land And Buildings property tax is a levy on certain types of physical property, such as homes, real estate and land. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. How much you pay in property taxes each. property taxes are a. What Property Tax Is Based On The Value Of Land And Buildings.

From www.lexidy.com

THE RULES YOU NEED TO KNOW ON LAND VALUE TAX Lexidy Law Boutique What Property Tax Is Based On The Value Of Land And Buildings the tax is usually based on the value of the owned property, including land and structures. property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. property taxes in the u.s. click on a state to find the most current information about. What Property Tax Is Based On The Value Of Land And Buildings.

From commonground-usa.net

Land Value Taxes—What They Are and Where They Come From Common Ground What Property Tax Is Based On The Value Of Land And Buildings a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. Are based on the market value of a property, including land and alterations to that land (including buildings). click on a state to find the most current information about property tax. What Property Tax Is Based On The Value Of Land And Buildings.

From www.dreamstime.com

2024 Property Tax on Land and Buildings Land Registry Fees and What Property Tax Is Based On The Value Of Land And Buildings the tax is usually based on the value of the owned property, including land and structures. property taxes in the u.s. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. click on a state to find the most. What Property Tax Is Based On The Value Of Land And Buildings.

From studylib.net

Property values and taxes What Property Tax Is Based On The Value Of Land And Buildings How much you pay in property taxes each. Are based on the market value of a property, including land and alterations to that land (including buildings). a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. property tax is a levy. What Property Tax Is Based On The Value Of Land And Buildings.

From ppabv.com

Understanding “Land Value” and What it Means for Your Property Taxes What Property Tax Is Based On The Value Of Land And Buildings property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based on an assessment of your. How much you pay in property taxes each. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories,. What Property Tax Is Based On The Value Of Land And Buildings.

From www.dreamstime.com

Land Registry Concept Image with an Imaginary Cadastral Map of What Property Tax Is Based On The Value Of Land And Buildings Are based on the market value of a property, including land and alterations to that land (including buildings). These additions to unaltered land. the tax is usually based on the value of the owned property, including land and structures. property taxes are a type of ad valorem tax—the term is latin for according to value—that is calculated based. What Property Tax Is Based On The Value Of Land And Buildings.

From parkerhartley.co.uk

Land & Property Taxes What Property Tax Is Based On The Value Of Land And Buildings How much you pay in property taxes each. These additions to unaltered land. the tax is usually based on the value of the owned property, including land and structures. property taxes in the u.s. Are based on the market value of a property, including land and alterations to that land (including buildings). a property tax is a. What Property Tax Is Based On The Value Of Land And Buildings.

From www.slideserve.com

PPT Municipal Finances, Resource Mobilisation and Municipal Budget What Property Tax Is Based On The Value Of Land And Buildings How much you pay in property taxes each. property taxes in the u.s. the tax is usually based on the value of the owned property, including land and structures. a property tax is a tax levied on the value of real property (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and. . What Property Tax Is Based On The Value Of Land And Buildings.